This week’s newsletter highlights what’s happening across the Chamber and throughout the Silver Lake community. We’re sharing details about our upcoming March Networking Mixer at The Chocolate Dispensary, welcoming Discount Medical Pharmacy, highlighting updates from our Chamber Realtors, and featuring several neighborhood updates including the start of construction on the Glendale–Hyperion Bridge, the reopening celebration of the Silver Lake Branch Library, and a new LADOT community survey. You’ll also find information about our upcoming Local SEO workshop and this week’s Member2Member feature from The UPS Store.

Read more below:

Join us for our March Mixer on Thursday, March 19th from 6:30pm–8:30pm at one of Silver Lake’s sweetest neighborhood spots. Mix and mingle with local professionals, entrepreneurs, and creatives in a welcoming, relaxed setting designed to help you connect with your local business community.

🍫 Food and Drinks

Guests can explore and purchase from The Chocolate Dispensary’s curated selection throughout the evening. Light bites and treats will be available to enjoy while you network.

🗣️ Be Ready to Share

Come prepared with a brief introduction about yourself, who you are and what you do, so others can easily connect with you. Don’t forget your business cards!

🚗 Getting There

Street parking is available nearby, and rideshare is encouraged. An Uber credit from the chamber will be available – members only! Codes will be distributed on the event date.

We hope you’ll join us for a great evening of connection and conversation!

Wondering what our mixers are like? Check out our November Mixer here!

Discount Medical Pharmacy

Discount Medical Pharmacy is a trusted local pharmacy offering immunizations, medication therapy management, diabetes education and support, and more. Conveniently located in the Gelson’s Shopping Center, they also provide delivery services to make care even more accessible. They’ll be moving soon, so stay tuned for updates on their new address!

(323) 661-8366

2716 Griffith Park Blvd.

discountmedicalpharmacy@hotmail.com

discountmedicalpharmacy.net

Here’s what our Chamber Realtors are up to:

• Julie Mollo Homes Group: 2018 Griffith Park Blvd #109 — Fully renovated 2-bed, 2-bath in the heart of Silver Lake. More info HERE.

• Fenton Real Estate: 4244 Brunswick Ave — Beautifully 3-bed, 3-bath reimagined Atwater Village residence. More info HERE.

• Tracy Do: 2321 Lakeview Ave — 1930 Spanish 3-bed, 2-bath tri-level home with sweeping hillside views in Silver Lake. More info HERE.

• Fatima Malik: 440 Raymond Ave #7 — Light-filled 1-bed, 1-bath located in one of Santa Monica’s most vibrant coastal neighborhoods in Ocean Park. More info HERE.

• The Local Real Estate Group: 932 S Harvard Blvd — 3-bed, 2-bath classic Craftsman home in Koreatown. More info HERE.

• Pinky Jones: Check out Pinky’s Instagram and/or website for updates, listings and news.

• Tiao Properties: 2105-2107 E Cesar Chavez Ave — Historic, mixed-use, 30-unit property in Boyle Heights. More info HERE.

• Brittany Walter: 7617 Lilly Way — Contemporary 4-bed. 3-bath in North Hollywood for under $1M. More info HERE.

• Anthony Vulin / The Collective Realty: 950 N Kings Rd #160 — Bright and beautifully updated 1-bed, 1-bath, on one of West Hollywood’s most desirable streets, Kings Road. More info HERE.

• Paul Redmond: Check out Paul’s website for updates, listings and news.

• Kenya Reeves-Costa / The LA Homegirl: 4135 S Victoria Ave — 3-bed, 2-bath beautiful, light-flooded single-story home in View Park. More info HERE.

• Jade Devitt: Check out Jade’s Instagram and/or website for updates, listings and news.

• Mark Duncan / Think Real Estate: 317 W Palmer Ave — Flexible space in the heart of Glendale. Currently a church and zoned for multifamily. More info HERE.

• Anthony Mian: Check out Anthony’s Instagram and/or website for updates, listings and news.

• Trevino Properties: 611 N Buena Vista St — 3-bed, 2-bath main home with 2-bed, 1-bath ADU in Burbank. More info HERE.

• Romy Flint: Check out Romy’s Instagram and/or website for updates, listings and news.

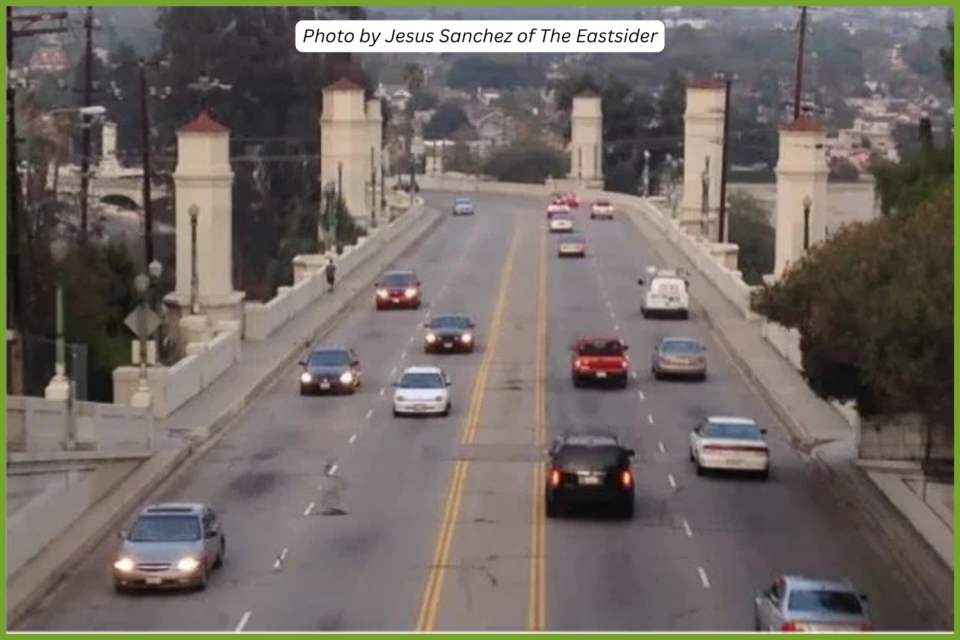

Construction finally begins this month on the Glendale-Hyperion Bridge

From The Eastsider: Renovations on the historic Glendale–Hyperion Bridge are set to begin this month, more than a decade after the project was first approved and following multiple delayed start dates.

The long-planned work, expected to take five to six years, will include realigning the I-5 northbound off-ramp so drivers can turn directly west. The project is now estimated at $208 million, down from earlier projections of $250 million.

Read the full story on The Eastsider HERE.

The Silver Lake Branch Library is reopening its doors!

The Silver Lake Branch Library is reopening, with celebrations led Chamber member Friends of the Silver Lake Library (FOSLL). A soft opening on Thursday, February 26 at noon is followed by a full Grand Reopening Celebration on Saturday, February 28 from 9:30am–5:30pm. Expect live music, a book sale, library swag, and activities throughout the day as the community comes together to welcome this beloved neighborhood space back. More info HERE.

The City of Los Angeles Department of Transportation (LADOT) has officially launched an online survey for the Sunset/Chavez Safety and Mobility Project and is inviting community members to share feedback. The project focuses on improving safety, accessibility, and mobility for pedestrians, cyclists, transit riders, and drivers along Sunset Boulevard and Cesar Chavez Avenue.

Community input will help shape future improvements, and participants who complete the survey by March 31, 2026 can join the mailing list and be entered for a chance to win a $50 gift card. Take the survey here: https://bit.ly/SunsetChavez_Survey. More info HERE.

Local SEO in 2026: Get Found by Customers Near You on Google and AI Search

Wednesday, February 25th at 2pm

In this session, you will learn how to:

• Understand the new local search landscape in 2026

• Appear in the Local Pack consistently

• Optimize your Google Business Profile like a pro

• Use reviews, reputation, and local content to boost rankings

• Improve technical signals that impact local rankings

• Track and measure your local results

The UPS Store

**20% discount on printing business cards and other printing, 5% discount on shipping, 15% discount on packaging, 20% discount on secure shredding, 2 months free on 12 month private mailbox service contract**

The UPS Store offers packing, shipping, printing, mailboxes, notary services, and so much more. From fragile items to everyday shipments, their Certified Packing Experts® carefully pack and ship your items so they arrive safely, backed by the Pack & Ship Guarantee. They also provide convenient mailbox services with package acceptance from all carriers, a real street address, and email or text notifications, keeping your mail and deliveries secure until you’re ready to pick them up. With flexible hours and a full range of services including shredding, copying, and printing, The UPS Store at 1110 N Virgil Ave is a reliable, one-stop resource for both personal and business needs!

Anthony Ghidotti

1110 N. Virgil Ave.

(323) 644-2621

store4838@theupsstore.com

https://locations.theupsstore.com/ca/los-angeles/1110-n-virgil-ave